Improve Your Driving Skills & Road Safety...

Driving can be a hazardous pastime, especially if the weather, road or traffic conditions are working against you. There are so many things that can really help you in a driving crisis, such as knowing what to do if you go into a skid on the road - should you steer into the skid - in the same direction your vehicle is moving, or try to move in the opposite direction? When is it safe to overtake and when should you stay where you are? But where can you go to find answers to questions like this? As there was no authoritative place on the Internet for motorists to go to for help and advice.

Driving Laws You Didn’t Know You Were Breaking

Everyone works hard to swot up before their driving test, but how many of us actively keep up to date with rules of the road? Our recent Driving Genius quiz revealed many drivers are a bit rusty when it comes to the rules of the road, confused about driving protocol, new laws, penalties, and roadside etiquette. To help separate fact from fiction, we’ve tackled some of the main motoring knowledge gaps as revealed in the quiz results. So what did our Driving Genius quiz uncover?

Lost peripheral vision. Can I still drive?

If you lose your peripheral vision in both eyes, for example following an accident, can you continue to drive a car?

Lost your speeding ticket? Find out who to call.

I got caught speeding and received my ticket but I have now lost it. Who do I ring to get another 1 issued? I need to know asap as I think it is almost due.

Skidding and how to avoid it

Have you ever experienced a skid when driving? It can be an unnerving experience to suddenly feel that you are losing control over your vehicle, even for just a split second. Skidding can be extremely dangerous and is often the cause of traffic accidents. This article looks at the reasons behind skidding and the steps that you can take in order to avoid skidding.

Parallel and reverse parking

Parallel parking (otherwise known as reverse parking) is often thought of as one of the most challenging driving skills for a new driver to get the hang of. It can be difficult to get right, even if you are not a new driver.

Everything You Need To Know About How To Tow A Caravan

We all need a break occasionally – a chance to switch off from the stresses and strains of everyday life and spend some quality time with our loved ones or by ourselves. Holidays offer us the perfect chance to do just that, as well as the opportunity to see the world and explore new places.

However, if this is your first time towing a caravan, it’s only natural that you might be a little unsure about how it works, the dos and don’ts and the various rules and regulations. Fear not – here at Jardine Motors, we’ve got you covered with all you need to know about how to tow a caravan.

Electric Car Maintenance: Everything You Need To Know

Are you considering joining the green car revolution? If you’re thinking about going electric, statistics show that you’re certainly not alone. Data from the Society of Motor Manufacturers and Traders for January 2021 reveals a 54.4% increase in the registration of battery electric vehicles compared to the same period last year.

Alongside the purchase price, insurance premiums and taxes, one of the main factors to take into account is the running costs. There are of course many advantages to owning an electric vehicle, but what about the issue of EV maintenance? Which parts are more susceptible to failure? Does electric car maintenance cost more than that of a standard vehicle? Here’s a handy guide to everything you need to know.

Driving Abroad After Brexit: Everything You Need to Know

Amid the upheaval that the COVID-19 pandemic has caused across 2020, it’s easy to forget that before it all the UK had, and still has, more than enough on its plate in the form of Brexit. Indeed, while we were all yearning for the news to be about anything but Brexit at the start of the year, we might even be glad to see it back if it means a sense of social normality returns in 2021.

A Guide To Safe Motorway Driving

Great Britain’s motorway network spans 2,300 miles and millions of us use it every day, which means it’s absolutely vital that we all practice safe motorway driving. Following these tips on how to drive on the motorway, hopefully, our roads will become a safer place for everyone.

As well as suggesting some basic motorway driving tips, we’ll examine whether smart motorways are safe and look at some of the best cars for motorway driving.

Car Cleaning Tips: 8 Steps To Clean Your Car Interior Like A Pro

There is nothing like a brand clean car that smells fresh. We all love sparkling clean glass and a dazzling dashboard. But with time, dirt and dust start to make surfaces lose their shine and look dull.

While some of us clean our cars often, we don't always spend much time cleaning the interior. We've put together a few steps on how to clean your car's interior and protect it.

Learning About the Blind Spot When Driving

Part of safe driving is fully understanding the situation of the road around you and always knowing where other drivers are. In a car it can be very easy to assume that everything you need to pay attention to is either out the front window, or the rear-view mirror, but this overlooks a critical area of driving. In every car, there is a part which is known as the blind spot: this is essential to be aware of.

How To Maintain Your Car When You're Not Driving Regularly

Perhaps you’ve moved to a city, plan to cycle to work, have a second car or simply won’t be using your car as regularly as you used to – and are wondering what to do to maintain it.

How often you need to put the engine on or check your tyre pressure always depends on how old your vehicle is, the condition of the car and how long you aren’t driving it for. With that said no matter how old the car is, if you leave it idle for weeks on end you stand the risk of the battery going flat, which means your car might not start.

Checking Your Brake Fluid & Topping Up

Most major vehicle manufacturers recommend that drivers should change their brake fluid at least every two years or 24,000 miles. This is because brake fluid is a hygroscopic fluid - meaning that it absorbs water over time reducing its effectiveness.

The only way to ensure that this doesn’t end up happening to you is to check that your brake fluid is changed at least every two years – preferably once a year. If you get your car serviced by a main dealer, this will automatically be checked at regular intervals as part of a service schedule.

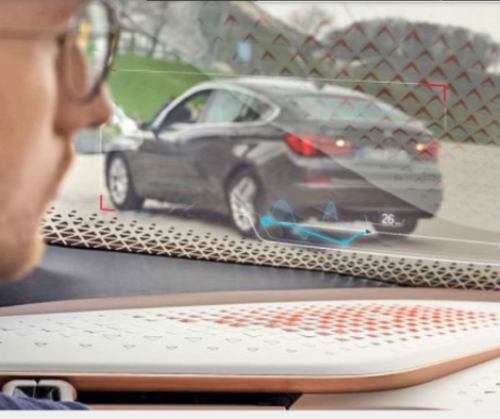

Your Definitive Guide to HUDs

The evolution of driving seat technology has changed dramatically in the last few years.

While the introduction of Head-up Display (HUD) may still seem like a futuristic innovation, HUDs are now available across various models – bringing a virtual experience to your everyday driving.

Don’t get left behind: read of guide to HUDs and get familiar with the car models making augmented reality the norm.

8 Best Driving Theory Practice Tests and Apps to Pass First Time

Taking your driving theory test can be daunting. But as with any exam, preparation is key. The problem is that there are hundreds of mock tests and practice questions online, and not all of them are genuine.

The best resources come from the DVSA (Driver and Vehicle Standards Agency) that sets the test. It gives regulated providers guidelines and practice questions that are similar to those used in the test. Since the test was updated in May 2018 with changes being made to the wording, and again in September 2020 with changes to the format, ensuring you use the most up to date practice material is pivotal.

10 Useful Tips For Learning To Drive

Learning to drive can be a stressful, time-consuming and financially draining experience. And it can seem daunting and overwhelming to learners.

But most of us need to drive. So we’ve put together a handy list of useful tips that will help you pass your driving test as quickly and cheaply as possible.

Level Crossings: How do They Work?

Though they may seem like relics of a bygone age, there are still around 6000 level crossings in use in Britain today. Together, they represent a significant safety hazard. On average 46 incidents take place at level crossings each week, resulting in six fatalities since 2013. The Health & Safety Executive has recognised the hazardous nature of level crossings by declaring that, other than in exceptional circumstances, no new level crossings will be built in Britain.

How To Transport Your Pooch Safely

48% of UK dog owners could be breaking the Highway Code by not restraining their dogs properly in the car, reveals the Dogs Trust.

Driving with your pet is sometimes a necessity, whether it’s a short trip to the vet or a longer trip for a weekend away. Many people don’t know the safest way to travel with their dogs though and some are unknowingly breaking the law.

DISCOVER MORE

Visit our YouTube channel, where you can find more car reviews and walkarounds by our fantastic experts.